Why Selling Your Home to Offerly is the Smart Choice

Discover the advantages of choosing Offerly for selling your property, from convenience to competitive cash offers.

Get a fair cash offer for your home without the hassle. No repairs, no showings, just a simple sale process.

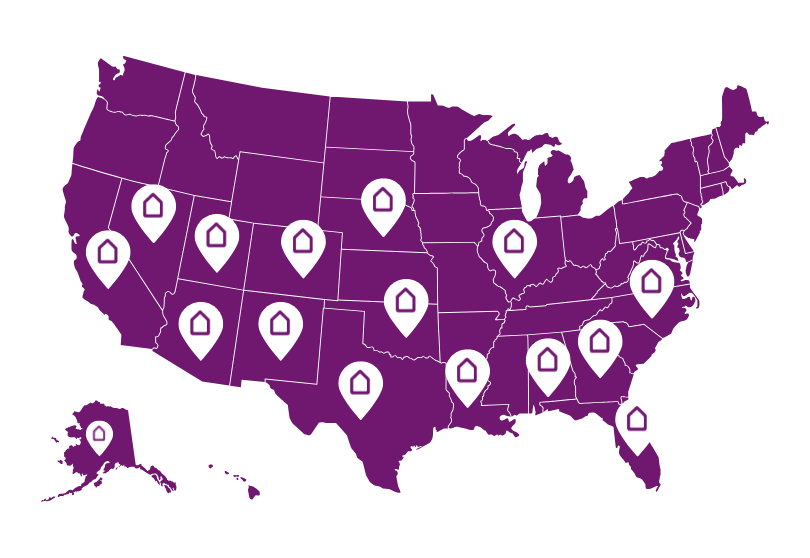

No matter where your property is located, Offerly provides a fast and fair cash offer. From coast to coast, our team is ready to help you sell your home quickly and easily. Skip the hassle of traditional selling and get the best offer today.

Why Choose Offerly

Experience a seamless and hassle-free home selling process with our comprehensive service offerings.

Get a fair cash offer for your property without any obligations or hidden fees. Quick, transparent, and hassle-free.

Sell your home as-is, without the need for costly repairs or upgrades. We buy homes in any condition.

Choose a closing date that works best for you, whether it’s a fast sale or a date that aligns with your schedule.

Avoid the 6% commission fees typically paid to real estate agents. Keep more of your money with Offerly.

Skip the traditional home selling process with a simple, streamlined approach designed to save you time and stress.

We provide clear, upfront offers with no hidden costs, ensuring you know exactly what you will receive at closing.

Why Choose Offerly?

Our team brings years of experience in the real estate market, ensuring you get the best cash offer for your home.

We handle all the paperwork, inspections, and logistics, so you can focus on your next move without stress.

Join thousands of satisfied homeowners who have chosen Offerly for a quick, transparent, and easy sale.

We tailor our services to meet your specific needs, ensuring a smooth and stress-free home selling process.

From fast cash sales to flexible closing options, we provide a range of solutions to fit your unique situation.

Our team is dedicated to providing quick responses and exceptional support throughout your entire home selling journey.

Our streamlined process integrates all aspects of the sale, from offer to closing, giving you peace of mind.

Step 1: Request an Offer

Fill out our simple form with details about your property, and our team will provide you with a competitive cash offer within 24 hours.

Step 2: Review Your Offer

Take your time to review the offer. If you have any questions, our team is here to provide clarity and address any concerns you may have.

Step 3: Choose Your Closing Date

Accept the offer and pick a closing date that works best for you. We handle all the paperwork, making the process stress-free.

Step 4: Get Paid

Complete the sale and receive your cash payment. It’s that easy — no hidden fees, no hassles, just a smooth transaction.

Services

What sets Offerly apart in the real estate market

Receive a competitive cash offer for your home without the need for repairs or showings. Sell your home quickly and easily.

Our offers are transparent and straightforward. There are no commissions, agent fees, or hidden costs involved.

You get to choose your closing date. Whether you need a fast sale or more time, we work around your schedule.

We handle all the paperwork and logistics, making the process as smooth and stress-free as possible.

Sell your home as-is. We buy properties in any condition, saving you the time and money on costly repairs.

Our team is here to support you every step of the way, providing clear communication and expert guidance.

We can close in as little as 7 days, getting you the cash you need when you need it most.

Our experienced team knows the local market, ensuring you get a fair and competitive offer for your home.

We take pride in our positive seller reviews. Your satisfaction is our priority, and we strive to exceed expectations.

Stay informed with the latest updates in the real estate market. Our blog features expert advice, tips on selling your home fast, and guides to help you navigate the process with confidence. Dive into our content to make the best decisions for your property journey.

Discover the advantages of choosing Offerly for selling your property, from convenience to competitive cash offers.

Learn how Offerly simplifies the property sales process for homeowners, offering a quick, efficient, and stress-free solution.

Explore the unique advantages of selling your property to Offerly. From quick cash offers to flexible closing dates, discover why homeowners trust Offerly.

Offerly simplifies the property-selling process. This guide walks you through our unique approach, highlighting how easy it is to sell your home quickly and efficiently.

FAQs

Explore common questions to understand how we simplify the home selling process.

Offerly makes selling your home simple and hassle-free. We provide a fair cash offer based on market data, without requiring repairs or showings. You can close on your timeline, avoiding the stress of traditional listings.

No, you don’t need to make any repairs. We buy homes in their current condition, so you can skip the costly fixes and sell as-is.

We offer flexible closing dates based on your needs. In many cases, you can close in as little as 7 days after accepting our cash offer.

Unlike traditional real estate transactions, we do not charge any fees or commissions. You get the full offer amount without hidden costs.

That’s completely fine! Our offer is no-obligation, and you can take your time to decide. We’re here to answer any questions you might have throughout the process.

Yes, our cash offer is 100% free with no obligation. You have nothing to lose by getting a quote, and it gives you a solid option if you decide to sell.

Get a Cash Offer Today!